How To Register A Legal Documente In Puerto Rico

Do It Yourself

Sign up for a costless account and use our online tools to first your Puerto Rico corporation today. Includes Puerto Rico incorporation and maintenance walkthrough and visitor document creation. All for gratis—just pay the relevant fees.

$ 0 Full

Become Monthly

Skip the state fees! Become a Puerto Rico corporation and the best of our services today. Includes EIN, hassle-costless maintenance, business accost & mail forwarding, Privacy past Default®, local Corporate Guide® service, and everything you need to operate at total capacity.

$ 50 / Month

Pay in Full

Get Puerto Rico corporation , business address & free mail forwarding, free 60-24-hour interval Telephone Service trial, Privacy by Default®, lifetime support from local Corporate Guides® and a year of registered agent servic due east .

$ 375 Total

Rated 4.5 / 5 stars by 317 clients on Google

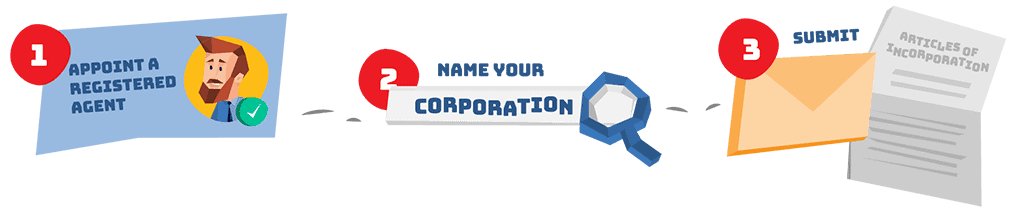

To start a corporation in Puerto Rico, you'll need to exercise three things: appoint a registered amanuensis, choose a name for your business, and file Certificate of Incorporation with the Department of State. You can file online or by postal service. The certificate costs $150 to file. One time filed, this document formally creates your Puerto Rico corporation.

1

Appoint a Registered Amanuensis

Per Puerto Rico Constabulary Title 14 § 3542, every Puerto Rico corporation must engage a registered amanuensis (besides known equally a "resident agent" or "agente residente"). You lot don't need to hire a registered agent, but if you lot do, make sure your registered agent will list their address on your certificate wherever possible to ensure maximum privacy.

ii

Proper name Your Corporation

If you're starting a new business, y'all probably already know what you desire to name your corporation. Simply you'll need to know if your preferred name is available. To notice out, visit the Puerto Rico DOS Corporations Search and browse until you observe the perfect proper name for your corporation.

three

Submit Puerto Rico Certificate of Incorporation

One time you lot know who your registered agent will be and what your corporation name is, you're set to file your Puerto Rico Certificate of Incorporation. Follow along with our filing instructions below:

Learn more than about each Certificate of Incorporation requirement below. Note that the information you lot provide becomes office of the public record—permanently.

Better yet, skip the form entirely and hire us to incorporate your Puerto Rico business. We provide a free business organisation address to list whenever possible throughout the filing to better keep your personal accost private. And for the cheapest style to starting time a business? Pay just $fifty out the door with our VIP monthly payment option.

1. Corporation Name

Your name must include ane of the following words or abbreviations: Incorporado, Corporación, Incorporated, Corporation, Corp. or Inc. Tip: Most businesses keep it unproblematic with "Corp" or "Inc."

ii. Designated Role

Listing your corporation'southward physical Puerto Rico address (and mailing accost if different).

3. Resident Amanuensis and Address

Your Puerto Rico registered agent must be bachelor to accept legal notifications on behalf of your business at a physical address in Puerto Rico. Tip: When you lot hire Northwest, our information will go here.

4. Purpose

Your purpose is the master business action you plan to engage in. You tin simply state that the purpose is to "engage in whatsoever lawful acts or businesses for which corporations may be established pursuant to 14 L.P.R.A. § 3502."

5. Authorized Shares

For each course, list the number and par value of each share. Par value (or "face value") is the value listed on stock certificates—typically the everyman value at which the share will exist sold. If you have multiple classes of shares, too indicate the total shares of all classes.

6. Share Rights and Limitations

Explicate any conditions, preferences, rights, restrictions or limitations for each share blazon.

7. Puerto Rico Incorporator

Your incorporator signs and submits your Certificate of Incorporation. Incorporators must include their names and addresses. Tip: We'll be your incorporator when you hire Northwest.

8. Directors

If your incorporator's powers cease upon filing (i.e. if your incorporator isn't a director), list the names and addresses of who will serve every bit directors at the commencement annual meeting.

ix. Term of Existence

How long do you want your corporation to exist? Your can choose "perpetual" (unlimited), "indefinite" (existing until a particular event) or "specific date" (which you'll accept to enter). Tip: Well-nigh corporations are perpetual.

10. Effective Appointment

When exercise you want your corporation to start? Yous tin either start on the date of filing or cull a specific date up to xc days in the hereafter—for instance, to line up with the start of a tax period.

xi. Email Addresses

Like all the information in your Certificate of Incorporation, the email you list volition become part of the public record. Tip: Avoid an inbox full of spam, rent Northwest, and you can list our e-mail address here.

Professionals in Puerto Rico hire registered amanuensis services like Northwest Registered Agent for incorporation—simply why?

Logistics

Standard filing companies don't have employees or offices in every state and Puerto Rico. Only as a national registered agent, information technology'southward a requirement for usa, which is a benefit for our clients. Our role is in San Juan, PR. We're on a first name basis with the people who work in the Section of Country. We know all the fastest filing methods, which translates to fast, professional person service—without extra fees.

Privacy

As your registered agent, nosotros list our San Juan registered office address on your corporation'due south formation documents. Why? If you lot're starting a business organization from your apartment in Ponce, do you really want your apartment address every bit your business address? (Hint: the answer is no.) We'll listing our address, so y'all don't have to list yours. Plus, nosotros never sell your data. Nosotros don't list your personal information on filings if we don't have to. Information technology's all standard and role of our commitment to Privacy by Default®.

Gratis Mail Forwarding, Business Address and More

At Northwest, we practise everything a registered agent should practice and more. Yous can listing our address as your business address on your land filings. Nosotros include limited digital mail forwarding with registered agent service (upwardly to v pieces of regular mail per yr; $fifteen a doc afterwards that).

Plan on accepting credit cards? We also offer a Gratis Credit Card Processing Consultation. Our specialists work with processors to negotiate depression rates and better contracts for our clients.

And now, try our in-business firm Northwest Phone Service for threescore days, free of accuse with our formation service. Go a virtual telephone number with your choice of area code, make and receive calls from whatever device, and more—for simply $9 a month.

Local Expertise

We know the in's and out's of each land and jurisdiction—and we use this knowledge to help you when you need information technology most. Our team of Corporate Guides® has over 200 local business experts. You can call or electronic mail u.s.a. for answers to all your questions about your corporation in Puerto Rico. Our Corporate Guides are dedicated solely to helping you lot with your business—not selling you services or coming together quotas.

After your Puerto Rico Certificate of Incorporation are approved, you even so take a few more important steps to have, including getting an EIN, drafting bylaws, holding your first meeting, opening a bank account, and learning about reporting and revenue enhancement requirements.

Become an EIN

Your federal employer identification number (unremarkably known as an EIN or FEIN) is similar to a social security number for your business. The IRS assigns these numbers and uses them to easily identify private corporations on revenue enhancement filings, including federal corporate income revenue enhancement returns.

Why does my Puerto Rico corporation need an EIN?

The IRS requires corporations to get an EIN for their federal tax filings, and the Puerto Rico Department of Treasury requires an EIN for their business registration. You may also exist asked for your EIN when opening a depository financial institution account, securing a loan, or applying for local business permits and licenses.

How practise I go an EIN for my corporation?

You lot can get an EIN directly from the IRS. The application is free, and most businesses tin employ online. Notwithstanding, if you lot don't accept a social security number, you'll demand to submit a newspaper application form. Tin't comport to fill up out yet another application? Hire Northwest to get your EIN for you lot. Just add on EIN service during checkout when you sign upward for our incorporation service. Or choose our VIP service—an EIN is included.

Write Corporate Bylaws

Bylaws are the internal rules you set for your business. They put into writing how decisions will be made and who gets to brand those decisions. All the major organizational processes and procedures for your corporation will go in your bylaws.

Do I need bylaws for my Puerto Rico corporation?

fourteen L.P.R.A. § 3508 (2019) notes that bylaws may be adopted past the incorporators, initial directors of a corporation, or by the board if no payment for shares has still been received. The statutes, however, don't specifically crave the adoption of bylaws.

However, corporate bylaws are important internal documents, and most corporations draft bylaws and keep them with other corporate records, such equally meeting minutes and resolutions.

What should bylaws include?

Corporate bylaws cover basic policies and procedures for bug such as company finances and direction. Bylaws should cover a range of topics, answering key questions like those below:

-

Meetings: When and where will meetings for shareholders and directors exist held? How many attendees are required to transact business? What are the procedures for voting or proxy voting? How do you call a special meeting? What actions canCorporate Guides exist taken without a meeting?

-

Stock: How are stock certificates issued and transferred? How is voting afflicted by issues such as corporate stock owners or fractional shares?

-

Directors and officers: How many directors must there be? Which officer positions are required? What powers do they take? How practise yous fill a vacancy or remove a managing director or officer?

-

Finances: What are the procedures for retaining profits, issuing dividends, and paying bills? Who can withdraw money from the corporate bank business relationship or sign checks?

-

Records: Where is the corporate volume to exist kept? What information will exist maintained? How are requests for review or access honored? Can records or copies be kept or distributed digitally?

-

Amendments and emergencies: Who can meliorate bylaws and how? Can emergency bylaws exist adopted in the case of disaster?

Puerto Rico bylaws can brand other provisions also, bold additions are in accord with local laws. For example, 14 L.P.R.A. § 3562 (2019) states that bylaws tin specify the qualifications required for corporate officers.

How practise I write bylaws?

Creating bylaws tin can exist overwhelming—where do y'all start? Northwest can aid. Nosotros give yous free corporate bylaws when you lot hire united states to form your Puerto Rico corporation. We know what kinds of topics and questions corporations demand to address, and nosotros've spent years refining and improving our forms. We offer many other gratuitous corporate forms as well, including templates for resolutions and meeting minutes.

Hold an Organizational Coming together

An organizational meeting is the beginning official coming together of the corporation after the business is legally formed with the republic. At this meeting, bylaws are adopted, officers are appointed, and any other initial business is conducted. The commencement meeting minutes should also be recorded and added to your corporate record book.

Are in that location any special rules for Puerto Rico organizational meetings?

You lot're required to give a minimum of two days detect before belongings the meeting. Attendees can, even so, waive their required notice in writing. The coming together doesn't take to be held in Puerto Rico.

Open a Corporate Depository financial institution Account

Businesses that mix personal and business finances together risk losing their liability protections, so your corporation will need its ain banking company account. In addition, a corporate bank account is essential for hands accepting payments, paying bills and holding funds.

How do I open a bank business relationship for my Puerto Rico corporation?

To open a corporate bank business relationship in Puerto Rico, you'll need to bring the following with you to the bank:

-

A copy of the Puerto Rico corporation'south Certificate of Incorporation

-

The corporation'due south bylaws

-

The corporation's EIN

If your bylaws don't specifically assign the power to open up a bank account, you may also desire to bring a corporate resolution to open up a bank account. The resolution would land that the person going to the banking concern is authorized by the business to open the business relationship in the name of the corporation. At Northwest, we provide free corporate bank resolutions, along with many other free corporate forms, to assist yous become started fast.

File Puerto Rico Reports & Taxes

In Puerto Rico, corporations file an annual report each twelvemonth. Tax-wise, as a U.S. territory, the commonwealth handles things differently than near states, and corporate taxation rates depend on a multifariousness of factors.

What is the Puerto Rico Annual Report?

The Puerto Rico Annual Report is a filing you lot must submit each year. The territory requires more information for an annual written report than most states. In addition to updating information on directors, officers, registered agent and shares, you must also provide a argument detailing the financial condition of your corporation for the previous year.

If your total revenue is less than $3 1000000, this financial argument tin can be prepared by someone with full general accounting knowledge. Nevertheless, businesses with revenue over $3 one thousand thousand must have their written report audited by a certified public accountant licensed in Puerto Rico.

How much is the Puerto Rico Almanac Written report?

The annual report has a apartment fee of $150.

When is the Puerto Rico Annual Report due?

The filing is due no later than Apr 15. For-profit corporations that miss that deadline without filing for an extension can suffer considerable fines at the Department of State's discretion, ranging from $750 up to $2000. Repeated failure to file almanac reports can lead to administrative dissolution for your corporation.

These filings can be easy to forget—which is why nosotros send our clients automated reminders for your Puerto Rico Annual Study filings. Or amend however, permit us file for you. With our business renewal service, we can consummate and submit your annual study for y'all for $100, plus the $150 Department of State fee.

What should I know well-nigh Puerto Rico corporate taxes?

Because Puerto Rico is a Usa territory, corporate taxes are a little different, and the taxes you pay depend on residency, business concern activities, income sources, and more than. Some corporations pay equally a footling as four%, and others pay much more than. For an overview of Puerto Rico concern taxes, cheque out our Puerto Rico Tax Advantage page.

The full Puerto Rico sales tax is xi.5%, 10.5% for the commonwealth and 1% for municipalities.

Do corporations have to register with the Puerto Rico Department Of Treasury?

Yes, if you will be a taxpaying employer in Puerto Rico, you're required to register with the Puerto Rico Department of Treasury (Departamento de Hacienda). You can register via the Treasury'southward online portal SURI. Yous'll need your EIN before y'all can register.

How can I submit the Puerto Rico Document of Incorporation?

You can file your Puerto Rico Certificate of Incorporation online or by mail. The address for the Department of State is:

Departamento de Estado de Puerto Rico

Calle San José, Plaza de Armas

San Juan, PR 00901

How much does it cost to start a Puerto Rico corporation?

Puerto Rico charges a flat $150 to file a Certificate of Incorporation as a for-profit corporation.

Rent us for a one-fourth dimension fee of $375, including the Section of State filing fees, a year of registered agent service, and more. Or, pay only $l out the door with our VIP monthly payment option.

How long does it take to start a Puerto Rico corporation?

Filing your Certificate of Incorporation generally takes less than a solar day to complete.

If you hire Northwest to start your corporation, we file online and typically have your Puerto Rico corporation formed within 24 hours.

Does a Puerto Rico corporation demand a business license?

Most businesses volition need a license. If y'all plan to appoint in any business in a Puerto Rico municipality, y'all'll have to get a "Patente Municipal" license—a municipal tax license. The tax is based on turnover (sales) with variable rates. If y'all fail to register, in that location's a fine of up to $500 in many municipalities. Also, if you have a physical office or location in Puerto Rico, you'll too need to obtain a Use Permit before y'all brainstorm operating. The permits are available from either your municipality or the Office of Management of Permits.

For some license applications you may need an EIN or a certified re-create of your Certificate of Incorporation. At Northwest, we tin streamline the procedure and go these for y'all—simply add on these items during checkout.

What is a foreign Puerto Rico corporation?

A corporation formed exterior of Puerto Rico—but which conducts business in the territory—is considered a foreign Puerto Rico corporation. For instance, if you incorporated in Florida but determine to open a storefront in Puerto Rico, you would exist a foreign Puerto Rico corporation. This also ways you would demand to register with the Department of State by filing a Certificate of Authorization for doing Business in Puerto Rico. Foreign corporations are required to file the Puerto Rico Annual Study as well and are also subject to the commonwealth'southward relevant corporate taxes.

Can Northwest assist me class a nonprofit corporation?

Absolutely! We're happy to beginning a nonprofit corporation for you lot. Nonprofits but pay $5 to file a Certificate of Incorporation, and annual reports will only cost $five too.

How can I get a Puerto Rico phone number for my corporation?

Information technology'south a puzzler: yous need a local number to display on your website and requite to customers, but you don't desire to make your personal number quite then…public. We get it. And we've got yous covered with Northwest Telephone Service. Nosotros can provide you with a virtual telephone number in any state—plus unlimited telephone call forwarding and tons of easy-to-use features. You can try Telephone Service free for threescore days when you hire us to form your corporation, and maintaining service is only $9 monthly later on that. No contract required.

Our Puerto Rico incorporation service is designed to be fast and piece of cake—signing upward takes but a couple minutes. Here'southward how it works:

1

Signup

We offer flexibility with 2 dissimilar options for payment. You tin pay everything upward front, which includes a full year of registered amanuensis service. Or, pay just $50 out the door with our VIP monthly payment selection. With our VIP option, we also include an EIN. Just choose one of the buttons below, answer a few easy questions about your business organization and submit your payment.

ii

Department of State Approval

Side by side, nosotros'll fix and submit your Puerto Rico Document of Incorporation to the Department of State. In the meantime, y'all'll have immediate access to your online account, where you can discover useful land forms, pre-populated with your business concern data.

3

Your Puerto Rico Corporation!

Once the Puerto Rico Department of Land has approved your filing, nosotros notify you that your Puerto Rico c orporation has been legally formed. You can now m ove on to next steps, like property your organizational meeting and opening a bank account.

Source: https://www.northwestregisteredagent.com/corporation/puerto-rico

Posted by: watlingtonthestive.blogspot.com

0 Response to "How To Register A Legal Documente In Puerto Rico"

Post a Comment